Schools are designed to teach skills and subjects to prepare children for college or the working world, such as reading, math, science and more. Elementary and secondary education emphasize broad knowledge, exposing children to a variety of ideas and topics. But there’s one topic that many schools don’t teach America’s students: financial literacy.

According to a 2015 study by the Financial Industry Regulatory Authority (FINRA), teaching financial skills to kids before they enter college or the workforce is crucial to helping them grow into adults who can achieve financial security and success. And yet, only 20 states mandate that high school students study economics, two fewer than in 2014, according to a CNBC article by Shelly Schwartz. What’s more, only 17 states require students to study personal finance.

Since 2013, the Consumer Financial Protection Bureau (CFPB) has been pushing for regulations requiring all 50 states to mandate financial literacy training for kids in elementary and secondary schools, Time reports. “Young people are not prepared to manage their finances when they reach adulthood,” the CFPB says. “At the same time, the current financial services marketplace is increasingly complex. In the face of this very real need, American education should include approaches to teach young people about their finances.”

The Importance of Financial Literacy for Kids

Defining Financial Literacy

Financial literacy is “the ability to use knowledge and skills to make effective and informed money management decisions,” according to Investopedia. Math is certainly part of financial literacy, but so is the ability to understand one’s credit rating, to avoid and pay down debt, and to understand how financial transactions and products work in order to make informed financial decisions.

How It Can Be Taught

It’s important to take an active hand in preparing kids for the financial world. Financial literacy can be taught to students as part of other subjects like math or history, or on its own, such as with modules like those created by the High School Financial Planning Program. Such education needn’t focus on complex economics topics. Rather, it should focus on topics that are easy for students to learn and that have immediate practical application. The CFPB has five recommendations:

- Start financial literacy as early as kindergarten, and require a stand-alone personal finance course for high school students.

- Include personal finance questions on standardized tests.

- Provide students with hands-on learning opportunities, so they can use their finance skills.

- Train teachers in personal finance and offer them incentives for teaching it in their classes.

- Give parents the tools they need to discuss financial topics at home.

Why Financial Literacy Matters

Teaching kids personal financial literacy early and throughout their educational career carries tangible benefits into their adult lives. “What if when young people started their first job, they already [knew to] put money into their retirement account?” economics and accountancy professor Annamaria Lusardi told U.S. News & World Report. “If young people could do this at age 20 rather than age 50, it would make an enormous difference.” These skills can be integrated into existing lessons, such as by teaching about the financial implications of the Great Depression in history class.

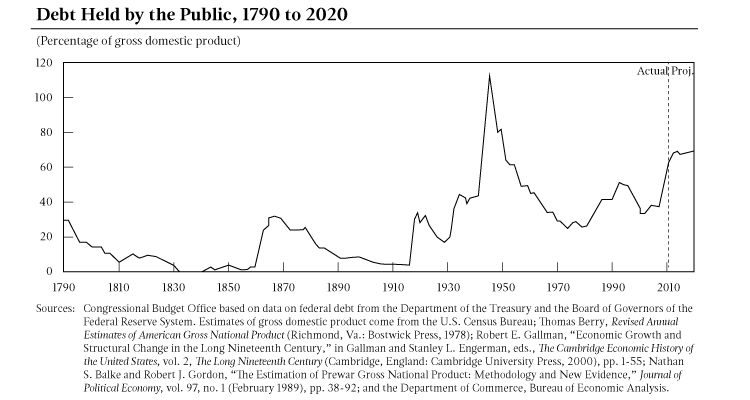

Personal finance is difficult to navigate on one’s own, and “the complexity of the financial system exploded over the past few decades,” according to Bloomberg columnist Mark Buchanan. A physicist, Buchanan describes how financial systems interact with each other in ways that are hard to predict and decipher, which “helps financial institutions hide the risks they create.” Financial literacy can help students discern these risks for themselves as they enter the adult world and help them avoid risks, too.

Young people are increasingly unable to manage their financial health effectively. More than 20 percent of renters between ages 18 and 24 overspend their income by $100 or more on a monthly basis, writes Martha C. White of Time. She cites a related statistic: that people born between 1980 and 1984 carry, on average, $5,689 more of credit card debt than their parents did at their age. People in this age range are also paying off their debt at a dramatically lower rate than their parents did, meaning that many of these young people will never pay off their credit card debt. Consistent training in basic financial literacy could help alleviate much of this problem.

Benefits of Financial Literacy

Students who learn to manage their finances early and often become adults who are better equipped to live independently. By teaching kids to make good financial decisions, they learn to pay down debt or avoid it altogether. Lusardi, in her research summary on “The Importance of Financial Literacy,” explains that “individuals make many financial decisions and … those decisions are highly interrelated.”

White explains that 42 percent of young renters report rent as their top expense. Overpaying on rent means less money for bills, food, transportation and other expenses, which increases the likelihood of spending with credit cards. These credit cards then become another monthly expense, contributing to the cycle of debt and preventing the young person from planning for the future by investing or saving money.

Paying down debt and maintaining a good debt-to-income ratio contribute to a young person’s credit score. A young person can then use a good credit score to get better mortgage rates, more attractive financing options on cars and other important financial benefits, according to U.S. News & World Report.

Students who learn to navigate the world of debt and credit will tend to have more money for savings, which can help pay for large expenses without relying on credit, and they can set aside money for retirement accounts. In order to retire, one must be able to set aside enough money to meet annual expenses without an income, a figure that can easily exceed $1 million, according to Forbes. A young person struggling with credit card debt will have a hard time accumulating that kind of money for retirement.

“In this research, we document notable improvements in credit outcomes for young adults who take personal finance courses in high school,” the 2015 FINRA study says in its conclusion. The study cites a statistically significant increase (as much as 5.2 percent) in student credit scores only two years after financial literacy education was mandated in the state, and a statistically significant decrease (as much as 8.4 percent) in the number of students who were 90 or more days delinquent on credit card payments after only one year. If teaching kids financial literacy in high school can have this kind of effect after only a short period of time, imagine the effect that a thorough financial education nationwide could have on future generations.

How You Can Make a Difference

The online MA in School Improvement degree program from Campbellsville University focuses on improving school curriculum and education outcomes, so you can gain the skills you need to lead initiatives like financial literacy.